After the mini-budget on September 23, the markets reacted to a bad policy: Truss’s strategy to undertake massive tax cuts without providing much certainty on how this would be funded. Its reversal brought bond yields down from recent highs (essentially reducing the cost of government borrowing) and saw the pound appreciate. But overall, the market losses seen following the mini-budget have barely been recovered.

To investors, sound and stable economic policies matter much more than the person residing in Number 10. And that’s why, even with a new prime minister, recent market movements indicate investors continue to see more significant issues with the UK economy, both immediately and over the longer term.

In the short term, yields on UK sovereign bonds have shot up after the mini-budget, increasing the government’s cost of borrowing. The lack of an accompanying forecast by the Office of Budgetary Responsibility (OBR) exacerbated this negative reaction.

Before this, the Bank of England had been contemplating a bond-selling exercise to try to bring rising inflation back to its 2% target by reducing the supply of money in circulation (this is known as quantitative tightening). Instead, it had to quickly change course after the mini-budget. It not only postponed this tightening, but also restarted quantitative easing and bond purchases, promising to buy up to £10 billion in gilts per day to address a related crisis among pension funds.

Two things will now determine future sovereign bond yield dynamics and dictate government borrowing costs.

First, clarity on how long the Bank of England plans to continue its policy of quantitative easing (buying bonds to keep yields low) before it reverts to quantitative tightening again. Markets are watching these actions very carefully and any suggestion that this support by the Bank will be cut off could make traders and investors nervous.

Second, the government’s medium-term fiscal plan, currently scheduled for October 31, will also affect bond yields. Unlike the mini-budget, this plan will come with an in-depth assessment from the OBR, giving markets more information. Plus, the current chancellor, Jeremy Hunt, has brought some of the fiscal plan measures forward to ease market concerns.

It’s still unclear what kind of plan it will be, however. A debt-cutting strategy from Hunt and the new government headed by Rishi Sunak should assure the markets about the UK’s fiscal stability, but it’s still unknown whether this would happen via more taxes or less spending. Some evidence on what would be best for the economy supports raising capital income taxes (capital gains tax and inheritance tax) rather than cutting public spending or raising income taxes.

In the long term, the UK’s major problems are stagnating growth and lack of productivity. And if the new government addresses current problems by raising taxes and cutting spending – alongside higher interest rates from the Bank of England – there will be more economic pain.

Changing global economy

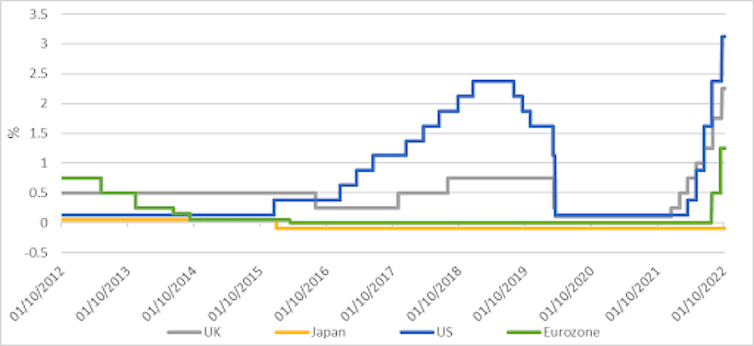

Many countries are suffering similar issues to the UK, contributing to a weak global economic outlook in general right now. After a prolonged period of historically ultra-low interest rates, increases – so-called normalisation of monetary policy – were expected in most countries. But a sharp surge in inflation due to Russia’s invasion of Ukraine and pandemic-era supply chain issues have caused most central banks to scramble to tighten monetary policy even further by increasing rates more rapidly.

Recent rate changes by central banks

These rate hikes and policy tightening strategies by central banks could create significant financial and fiscal instability. Already, the US Federal Reserve’s unwinding of its balance sheet from a peak of US$8.97 trillion (£7.9 trillion) in April 2022, for example, caused the dollar to appreciate by more than 13% in the last six months. This has created challenges for emerging market currencies, as well as major currencies – the yen, pound sterling and the euro – which have all depreciated considerably against the US dollar.

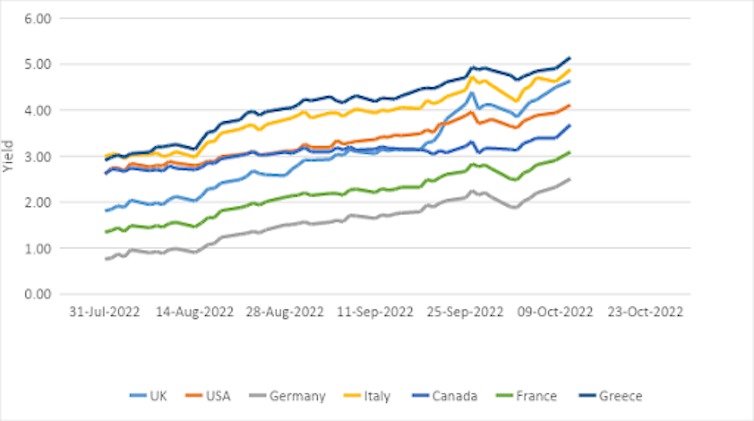

This has added to inflationary pressures, particularly in the Eurozone and UK, but it also affects sovereign bond yields, challenging economic stability in these countries. Since August, the cost of borrowing has more than doubled for many.

The rising cost of government borrowing

But to address rising inflation, even more central banks will want to shrink their balance sheets by selling bonds. The total size of the asset purchase programmes of the main four central banks alone is about US$26.7 trillion. With a weak global economy and these other financial fragilities, this is going to be a painful exercise for the global economy.

Indeed, such tightening will increase the cost of government borrowing further, creating major issues, particularly for highly leveraged governments, and those still paying off pandemic-era support such as the UK and Eurozone.

The UK specifically, is also dealing with a shift in the global economic centre of gravity away from its economy. In less than two decades, the UK has shrunk in relative terms from being an economy larger than China to being about nine times smaller. And the pound no longer enjoys the same status as the US dollar, meaning financial markets will punish it severely if it steps out of line.

This means the new UK government faces a tricky task in reigniting global investor confidence in its economic stability, even with a new prime minister widely seen as a steady hand.

Muhammad Ali Nasir, Associate Professor in Economics, University of Leeds

This article is republished from The Conversation under a Creative Commons license. Read the original article.

![]()