Miami has become one of the largest ecosystems in the region in terms of the number of startups and accumulated capital raised, but it lags significantly behind Sao Paulo in terms of value creation. Miami generated $ 55 billion in value, while Buenos Aires created $ 119 billion and Sao Paulo $ 107 billion, mainly due to the success of giants like MercadoLibre and Nubank. Miami could capitalize on its Latin American connection and become one of the two largest ecosystems in the region with Sao Paulo by 2030 if it internationalizes its startups. Miami's technology ecosystem has experienced explosive growth in recent years, with 470 startups registering in 2021 generating $ 55 billion in value and 90,000 jobs. Nine unicorns were born in 2021, and Miami received $ 5 billion in investment in local technology-based companies. In 2021, 73% of existing startups were created in 2010, and it is estimated that the funding opportunity will be around $ 25 billion by 2030.

Recently, a meeting of the Innovation Committee organized by the Argentine Chamber of Entrepreneurs in Miami was held to discuss the innovation ecosystem in Miami, its explosive growth in recent years, and what it needs to continue its evolution and consolidation globally.

We had the visit of Charly Esnal, Founder of Base Miami, and Elizabeth Piñón, Operating Partner at The Venture City.

What clear concepts are vital to share with the entire Anglo-Latino business community?

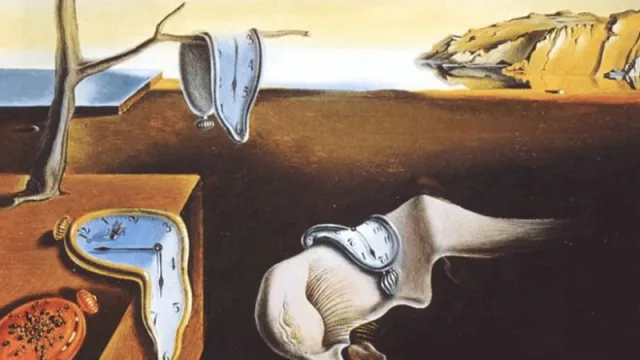

In IT, a unicorn refers to a project or company with unique potential. While a unicorn is a mythical creature, the idea of a tech unicorn is based on real-life. In venture capital, a unicorn refers to a new private company with a value of one billion dollars or more.

Venture capitalist Aileen Lee coined the term startup unicorn in 2013, and the reason behind the reference was the rarity of such companies, like the mythical animal. Lee counted only 39 companies that met her criteria in 2013, a list that included Facebook, LinkedIn, Workday, and Twitter.

As of February 1st, 2023, there are 1260 active unicorns worldwide.

Statistics as of November 1st, 2022 show that the US has the most active unicorns of any country with 667 companies, or 54% of the global total. Chinese unicorns are the second most common with 211 companies, followed by India (63 unicorns), the UK (36 unicorns), and Israel (29 unicorns).

Why are startups growing so much in Miami?

The growth of the startup ecosystem in Miami has been impressive. 2021 was the best year in the history of the technology community in Miami. In 2021 alone, 9 unicorns were born and Miami received $5 billion in investment in local technology-based companies, making it the second-fastest-growing ecosystem in the USA. In 2021, the 470 registered startups generated $55 billion in value and 90,000 jobs. 73% of the startups that exist today were created in 2010. It is estimated that by 2030, the funding opportunity will be around $25 billion.

However, the success of the local technology community took a long time. In 2006, Brian Breslin and others started gathering people under the umbrella of what eventually became www.refreshmiami.com. Medina began working in 2011 to launch the www.emergeamericas.com conference to bring technology executives from around the world to the region.

Positive signals were evident in the region in the early 2010s. Medina sold the local technology services company Terremark to Verizon for $1.4 billion. Rony Abovitz and Maurice Ferré sold MAKO Surgical, a medical device company in southern Florida, for $ 1.7 billion in 2013.

Since 2013, many organizations have started working in the region to connect members of the local tech community, organize important events, foster mentoring and funding networks, and create educational programs that help close the opportunity gap. Many investment funds have also established a presence in the area to support the growth of local startups.

What does Miami need to continue its evolution?

In the life cycle of ecosystems, Miami is in the second phase of globalization, preparing for the phase of attraction and global integration.

The 4 critical areas for the consolidation of the ecosystem are local connectivity, global connectivity, access to investment, and access to talent. Below are some reflections on each area in relation to the Miami ecosystem:

· Local connectivity: No matter the size of the community, it is essential to promote greater interaction between founders, investors, and mentors. Miami has good local connectivity that naturally includes several Latin American countries, and it will surely consolidate in the coming years.

· Global connectivity: In general, Miami concentrates entrepreneurs to develop their projects for Latin America. The connection is natural, as it is also with Spain. What we will see in the coming years is strong growth in global connectivity with ecosystems from other countries such as Israel, England, Germany, etc.

· Access to investment: Just as in sports, the "nursery" is important to ensure the future, it is also for an ecosystem. Although Series A investments are eye-catching, the key is to maintain high access to investment at the "seed" levels. Miami has had strong growth in seed investments, leveraging numerous public agencies born to empower the ecosystem such as the Miami-Dade Beacon Council, Enterprise Florida, and America's SBDC Florida. And surely, this level of investment will continue to grow, being the foundation of the future.

· Access to talent: In Silicon Valley, the universities of Berkeley and Stanford laid the groundwork for attracting and developing the necessary talent to make Silicon Valley a center of innovation and entrepreneurship worldwide. A story that has its years already, and what it shows us is the importance that the educational context gives to the development of ecosystems. It is essential that universities in Miami design more and more programs based on specific needs of entrepreneurs and launch research and technology transfer labs in areas such as biotechnology, nanotechnology, artificial intelligence, and life sciences to accelerate the growth of the ecosystem.

In which verticals does the Miami ecosystem excel?

Fintech, Crypto, and DEFI are by far the verticals with the most development, with almost half of all funding allocated to these sectors. Biotechnology, Lifescience, and Wellbeing is another vertical with a lot of development, where several Boston-based venture capital firms have opened offices in Miami.

How can one participate in the ecosystem if they are not an entrepreneur, investor, or mentor?

This is a question that arose, and the answer was that no matter what role one has or does not have, as long as we are willing to share ideas and experiences about a new world that is forming, energy and the desire to do things are more important than any label or role.

Patricio Guitart

Innovation Committee Coordinator - AACC - Miami

Founder of New Gen Ventures

Sources:

https://knightfoundation.org/wp-content/uploads/2022/06/Miami-Tech-Assessment_Final_2022.pdf

https://knightfoundation.org/wp-content/uploads/2020/06/Miamis-Startup-Ecosystem-Report-1.pdf

https://endeavormiami.org/guide-miamis-entrepreneurial-ecosystem/

https://www.techopedia.com/definition/31308/unicorn-technology

https://pitchbook.com/news/articles/unicorn-startups-list-trends

Tu opinión enriquece este artículo: