Summary and Tips:

Ualá, the Argentine fintech, has raised an additional $66 million in its Series E round, with the participation of Televisa Univision, bringing the total to $366 million. The company, valued at $2.75 billion, plans to use these funds to expand in Mexico and strengthen its services across Latin America. With 9 million customers in the region, including 6.5 million in Argentina, Ualá is poised to lead the digitalization of financial services.

The recent $66 million investment in Ualá, with the participation of Televisa Univision, is a testament to the dynamism and potential of fintechs in Latin America. With a clear focus on expansion in Mexico and strengthening its services in the region, Ualá is well-positioned to lead the digitalization of financial services. For anglophone-Latinos interested in business and technology, this is an opportune moment to explore the opportunities this growing market offers.

Highlighted Tips:

Keep a close eye on fintech investments and expansions in Latin America to identify business opportunities.

Leverage the growing demand for digital financial services in Mexico, a market with great potential.

Consider investing in companies that are transforming the payment, credit, and investment ecosystem in the region.

Stay informed about strategic alliances between fintechs and media companies to understand how trust and closeness with consumers are generated.

The Investment Round and Its Impact

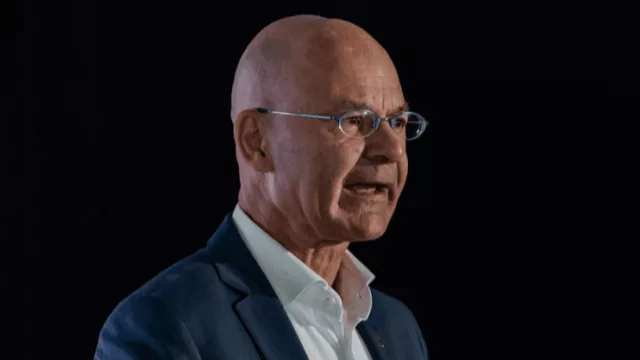

Ualá has increased its Series E round by $66 million in a second close that included the participation of Mexican media giant Televisa Univision. The funds raised through the sale of shares will be used to continue growing throughout Latin America, with a special focus on Mexico, according to founder and CEO Pierpaolo Barbieri. This amount brings the round, which began in November, to a total of $366 million, one of the largest in the region in recent years. The company was valued at $2.75 billion in the first close.

Expansion Strategy in Mexico

"Due to overwhelming demand from investors, we decided to raise a bit more," Barbieri stated in an interview. "This means we will be able to invest more to grow, especially in Mexico, but also to continue betting on the payment, collection, investment, and credit ecosystem in Argentina." Televisa, a highly relevant and influential media outlet in all Spanish-speaking markets, but especially in Mexico, is a strategic ally that will help Ualá build trust and closeness with Mexican consumers.

Ualá's Product Portfolio

Ualá, launched in 2017 in Argentina with a debit card, now offers a range of products including payments, credit, merchant acquisition, and investments, with services tailored to each country. The company has 9 million customers across the region, of which 6.5 million are in Argentina. Additionally, it is experiencing rapid growth of up to 15% monthly in its third market, Colombia, and does not rule out launches in other places in the region or mergers and acquisitions.

Opportunities in Latin America

"We see a region with very little investment where the need to digitalize, particularly financial services, goes beyond Argentina, Mexico, and Colombia," Barbieri commented. "We see a great opportunity on the continent, and not precisely in Brazil, where there are already a lot of new digital players." This vision underscores the growth potential and the need for innovative fintech solutions in Latin America, excluding Brazil due to its more saturated market.

Frequently Asked Questions (FAQs):

-

How much money has Ualá raised in its Series E round?

Ualá has raised a total of $366 million in its Series E round, including the second close of $66 million with Televisa Univision.

-

What is Ualá's main focus with the raised funds?

The main focus is expansion in Mexico and strengthening its services across Latin America.

-

How many customers does Ualá have in the region?

Ualá has 9 million customers across Latin America, of which 6.5 million are in Argentina.

-

What other markets is Ualá considering for expansion?

In addition to Mexico, Ualá is experiencing rapid growth in Colombia and does not rule out launches in other places in the region or mergers and acquisitions.

-

Why is the alliance with Televisa Univision significant?

Televisa is a highly influential media outlet in Spanish-speaking markets, especially in Mexico, and will help Ualá build trust and closeness with Mexican consumers.

Subscribe for free to receive all strategic information and be part of the largest business and culture community in the anglophone-Latino world!

Contact Infonegocios MIAMI:

Read Smart, Be Smarter!

Tu opinión enriquece este artículo: