Remember that rush of excitement when you landed your first job and tasted financial independence?

Sure, some bosses worked us late or expected weekend warrior dedication...but we felt important, like we were on top of the world with endless possibilities ahead!

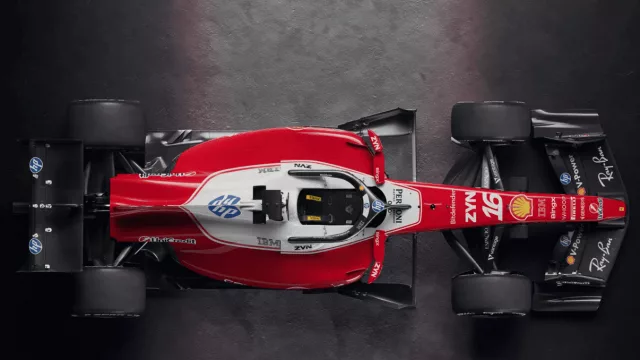

Then came the raises, the promotions, the family life, the kids, the bigger expenses—some essential, some just for the thrill of it, like that dream vacation or a sleek new ride…

Very few of us were glued to our bank statements back then. But then came those sleepless nights around 2010, when we started noticing a shift. Companies were merging, downsizing, or flat-out going under. Colleagues, friends, even family members were facing layoffs.

-

Suddenly, that sense of certainty morphed into uncertainty. Anxiety crept in as we eyed our investment portfolios, calculating how much we were actually saving each month or year—you know, just in case we got caught in the crosshairs of a corporate shakeup.

It didn't take long for that uncertainty to set in deep. We realized that our career trajectory wasn't a guaranteed ride into the sunset like our parents had it—retiring "old" with a gold watch and a pension.

Younger, hungrier talent was snapping at our heels, moving into positions of authority.

Our uncertainty grew as companies shifted their policies. Raises weren't as generous, expenses kept climbing, and our financial well-being became a source of stress.

-

We started petitioning HR departments, urging them to prioritize our well-being like their counterparts in other countries—you know, things like offering decent retirement plans. But their responses were lukewarm at best, nonexistent at worst.

Follow us on IG: @infonegociosmiami

And there we were, stranded in the middle of a financial desert, feeling lost, sometimes even kicking ourselves for not being more financially savvy. We were on our own, families in tow (if we were lucky), staring down an uncertain future.

We wondered if we had enough time to secure our futures—because what we had built, we were determined to keep. Many of us had already experienced firsthand the burden of supporting our parents in their retirement, a situation we were desperate to avoid.

For the more introspective among us, uncertainty eventually morphed into full-blown panic. "At 40, do I have enough time to dodge a retirement disaster and maintain my lifestyle?"

-

The answer, of course, is different for everyone. But the cold reality was that by 40, 40% of our working years were already gone. We had essentially cruised through 15 years without a financial plan.

We had prioritized spending over saving. And to add insult to injury, the companies we dedicated ourselves to hadn't lifted a finger to encourage us to invest or prepare for the very retirement cliff they were accelerating with their revolving-door employment policies.

But as they say, it's always better late than never. So we started to prioritize saving, which was easy enough for those of us who could allocate a portion of our income to investments and educate ourselves about long-term returns…

But then came the million-dollar question: How long would our hard-earned savings actually last?

That's when the ground beneath our feet really started to crack, sending shivers down our spines.

We started hearing about increasing life expectancy, how technology was adding an extra decade to our lifespans compared to 60 years ago.

That's when the carefree days officially ended.

We realized that achieving financial security post-retirement meant grinding for a little over a third of our lives just to support ourselves for the final third.

Talk about a harsh reality check! It was a crash course in the importance of financial wellness for our generation.

-

We learned that we were responsible for our own financial destinies, that building a robust investment portfolio required consistent effort over time. We also realized that companies had a social responsibility to implement retirement plans to ensure a smoother, less traumatic generational transition.

As the legendary Peter Drucker once said, “The best way to predict the future is to create it.”

Subscribe to Infonegocios Miami (suscribete sin cargo en)

https://infonegocios.miami/suscribite-al-newsletter

-

Contact Infonegocios MIAMI:

Tu opinión enriquece este artículo: