- How has Nvidia managed to open the doors to the democratization of AI through its partnership with OpenAI?

- What role do Nvidia processors play in the operation of ChatGPT and its impact on the popularity of this tool?

- What market share has Nvidia managed to capture in the artificial intelligence industry, according to Wall Street Journal data?

Updated data:

-

Nvidia's shares, based in Silicon Valley, rose by 5%, bringing its market value to $3.007 trillion.

-

The artificial intelligence chip maker Nvidia hit record highs in the market on Wednesday, surpassing a market valuation of $3 trillion and positioning itself as the second most valuable company in the world, ahead of Apple.

-

The latest increase in Nvidia's share value coincides with its upcoming stock split at a ratio of ten to one, scheduled for June 7, a move that could be attractive to individual investors.

-

The increase in Nvidia's share value comes as the company prepares to split its shares by ten starting on June 7, which could make it more attractive to retail investors.

-

Meanwhile, Apple's market capitalization reached $3.004 trillion, with a 2% increase in the value of its shares.

-

Microsoft remains the most valuable company in the world, with a market capitalization of $3.15 trillion, recording a 1.8% increase in the value of its shares during Wednesday's session.

1. Partnership with OpenAI for ChatGPT and its popularity

The democratization of AI has been made possible through the collaboration between Nvidia and OpenAI, where Nvidia's latest generation processors are fundamental pieces for the optimal operation of ChatGPT. This milestone has positioned Nvidia as the undisputed leader in supplying specialized processors for artificial intelligence, consolidating its presence in a highly competitive market.

Since late 2022, the term artificial intelligence has been on everyone's lips, thanks to the popularity of ChatGPT. Nvidia has been a key player in this scenario, as its processors specifically designed for the technology that powers ChatGPT have been crucial to its success. With a significant market share ranging between 70% and 90%, Nvidia has become the leading provider of processors for AI applications used by tech giants like Google and Microsoft. This market dominance has significantly boosted the company's profits, which increased by 400% in 2023 compared to the previous year.

2. Launch of Innovative Products with Artificial Intelligence

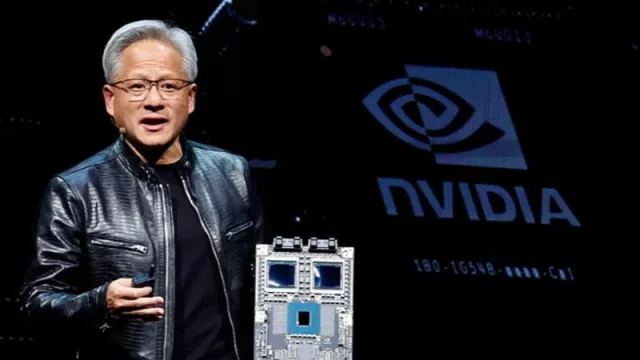

The visionary leadership of Jensen Huang, CEO of Nvidia, has been crucial in the development of innovative products that have set a new standard in the field of artificial intelligence. The recent announcement of Rubin AI, a new architecture designed to address the growing demands for computational processing in small businesses and home users, has generated great anticipation in the tech community. Moreover, the delivery of highly specialized AI supercomputers to leading companies like OpenAI showcases Nvidia's commitment to excellence and continuous innovation.

- What advantages will Rubin AI offer in terms of computational processing for small businesses and home users?

- How is Nvidia addressing the exponential growth of data and the need for more advanced computing models?

- What impact does the delivery of AI supercomputers have on the efficiency and response speed of systems like ChatGPT?

3. Data Centers and Nvidia's Latest Economic Report

The fundamental pillar supporting Nvidia's sustained growth lies in its robust data center infrastructure, which has achieved record quarterly revenues driven by the increasing demand for AI services in the cloud. These data centers, which act as the core of the digital infrastructure of numerous organizations, are key to supporting critical applications and business processes efficiently and securely. Nvidia's recent economic report reflects significant revenue growth, highlighting the substantial contribution of its data center segment to this success.

- How do Nvidia's data centers influence the implementation of AI services in the cloud?

- What importance do these centers have in processing and storing large volumes of data for applications like chatbots?

- What has been the impact of revenue growth in the data center segment on Nvidia's position in the global market?

4. Jensen Huang's Leadership

One of the key pillars of Nvidia's success has been the exceptional leadership of Jensen Huang, a visionary who has been able to guide the company towards excellence and innovation.

Nvidia's success is also largely due to Jensen Huang's exceptional leadership, who has been recognized by his employees as an outstanding leader. With a 96% approval rating among company professionals, Huang has demonstrated his ability to lead Nvidia to success in a highly competitive market. His strategic vision and focus on innovation have been crucial for the company's growth and expansion in the technology and artificial intelligence industry.

In a survey conducted by Blind in 2023, which evaluated CEO approval ratings by employees, Jensen Huang received the highest approval rating. An impressive 96% of verified Nvidia professionals on Blind endorsed his management as CEO, demonstrating the strong support and confidence he generates among his team.

Huang, along with co-founders Chris Malachowsky and Curtis Priem, established Nvidia in 1993 with the vision of developing graphics processors and artificial intelligence technology. His leadership has been instrumental in transforming Nvidia into a leading player in high-performance computing and artificial intelligence.

5. A Potential Lag by Apple

As Nvidia has risen in the ranking of the world's most valuable companies, we have observed a potential lag on the part of Apple, a company that has historically been a leader in innovation and market value.

Despite reaching significant milestones, such as the $3 trillion market cap mark in 2023, Apple has seen its position threatened by Nvidia's ascent. With the anticipation of WWDC 2024 (Apple's Worldwide Developers Conference), the tech giant has emphasized improving its tools with artificial intelligence.

According to reports from The New York Times, key executives like Craig Federighi and John Giannandrea have conducted tests with the OpenAI chatbot, ChatGPT, highlighting the limitations of Siri compared to Nvidia's capabilities in text generation and complex query resolution. This scenario raises questions about Apple's future in an increasingly competitive market dominated by artificial intelligence and large-scale data processing.

IG: @infonegociosmiami

-

Sign up for free, now, here.

Tu opinión enriquece este artículo: