A country that, according to the most precise audited data, holds 303.806 trillion barrels of proven oil reserves—the largest figure globally, above Saudi Arabia—faces critical paradoxes: long fuel lines (as well as lines for food and medicines), an oil industry in technical coma, and a web of geopolitical alliances that, rather than rescuing it, have indebted it and tethered it to a new form of dependence.

This exclusive analysis, backed by market-intelligence data, reveals the negotiating architecture of Nicolás Maduro’s government’s failure and why, in a tragic and ironic turn, the country with the world’s most oil suffers fuel shortages. A country that once had infrastructure financed by European and American capital and should have led production, but for over 15 years has been destroying its own framework.

DECONSTRUCTING A TECHNICAL INDUSTRY

Beyond falling production, there is neither human talent nor maintenance for refining crude for over 15 years.

-

Venezuela’s oil industry (PDVSA) didn’t collapse for lack of resources but due to a fatal triangulation of factors: 1) Expropriation and flight of critical talent (more than 70% of engineers and technical specialists have left since 2003). 2) Zero investment in maintenance and secondary/tertiary recovery technology. 3) Institutional corrosion where PDVSA shifted from a technical firm to a political cash cow.

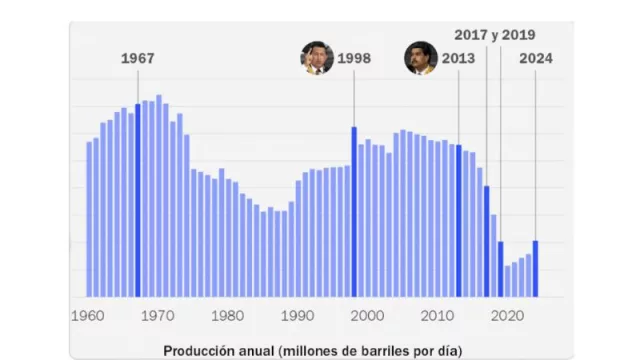

High-Impact Data: Current production runs about 800,000 barrels per day (bpd), per secondary OPEC sources. A dramatic drop from 3.5 million bpd at the end of the 1990s. Reactivating fields would require, in an optimistic scenario, more than USD 200 billion in investment and at least 5–7 years of intensive work.

STRATEGIC ALLIANCES (OR STRATIFIED DEBT)

Facing international sanctions and capital flight, Maduro’s government sought partners in the Russia-China-Iran axis. However, these negotiations, far from being rescues, have been prepay loans with future crude in onerous terms, delivering crude with a sledgehammer of debt. The result: the oil is given away, infrastructure degrades, and debt balloons. The performance is, frankly, dire.

-

With China: The China–Venezuela Joint Fund (over USD 62 billion disbursed since 2007) did not fund productive infrastructure but current spending. Repayment is via crude shipments, often below market price, in a volume-and-risk discount scheme that now tightens the treasury.

-

With Russia: Rosneft and other Russian firms took stakes in key projects (e.g., Petromonagas) in exchange for loans. Sanctions on Russia over Ukraine further complicated these operations, leaving projects incomplete.

-

With Iran: The barter of heavy Venezuelan crude for Iranian condensates (to blend and transport) and for gasoline shipments was a short-term patch with a very high geopolitical cost, aligning Venezuela with a country under maximum isolation.

Additionally, the lightly refined, poor-quality product has repeatedly been sent to Cuba for political negotiation, espionage services, and militia training.

Venezuela, its reality under a mismanaged regime:

OPEP-OPEC

The Fuel Paradox: To produce gasoline, refineries must run. The Paraguaná complex (one of the world’s largest refining capacities) operates at less than 15% of capacity. Without maintenance, spare parts, skilled personnel, and with heavy crude difficult to process without imported additives (which cost dollars that aren’t available), meeting domestic demand is mathematically impossible. Iran did supply gasoline, but it’s a drop in a sea of need.

15 Economic-Geopolitical Tips (Easy to Understand) on the Venezuela Case

-

Reserves ≠ Wealth: Oil underground with no ability to extract and sell is like a winning lottery ticket locked in a safe without a combination.

-

Talent Is Worth More Than the Barrel: Losing PDVSA engineers was worse than any sanction. Specialized knowledge is irreplaceable in the short term.

-

Sanctions Accelerate, Not Cause Root Problem: The collapse began years before the harshest U.S. sanctions (2017–2019).

-

Geopolitical Barter Is Expensive: Trading oil for political support buys air, not refinery capacity.

-

China Is Not a Philanthropic Partner: Its loans are business; if you don’t repay with oil, you forfeit assets.

-

Corruption Is an Invisible Tax: It’s estimated that over USD 300 billion in oil revenues were lost or diverted over 20 years—several times Venezuela’s external debt.

-

Without Investment, Oil “Molds”: Reservoirs require constant pressure. If water/gas injection stops, fields degrade permanently.

-

Heavy Crude Is a Narrow-Margin Business: It must be blended with light crude or condensates (expensive) to be marketable.

-

Russia and Iran Are Partners in Distress: Both have their own crises and sanctions. They cannot be Venezuela’s lifeline.

-

Gasoline is a Social Thermometer: Shortages paralyze the informal economy that sustains most of the population.

-

PDVSA Is a Paper Giant: Its market value is a fraction of what it once was; its debt is unsustainable.

-

The “Mining Arc” Is a Silent Confession: Focusing on mining (gold, coltan) signals the petroleum model is in ICU.

-

The Energy Diaspora Is a Boom for Others: Venezuelan technicians now lead projects in Guyana, Colombia, the U.S., and the Middle East.

-

Recovery Will Be Slow and Expensive: Even with a political shift tomorrow, bringing production to 2 million bpd would take a decade and global capital.

-

Guyana as the Inverse Mirror: While Venezuela contracts, its neighbor with recent discoveries is the growth frontier; geological irony.

THE FUTURE: EXIT OR VISCIOUS CIRCLE?

Reactivation requires, in order: 1) an internal and external political agreement; 2) a legal framework to attract supermajors (Exxon, Chevron, Shell, TotalEnergies) and their multi-billions in capital; 3) a talent-repatriation program with incentives; 4) debt restructuring with China and Russia, likely with discounts and asset swaps.

Until that happens, Venezuela remains the energy paradox of the 21st century: the king beggar sitting on a throne of black gold.

OPEP OPEC Source: The Organization of the Petroleum Exporting Countries (OPEC) is an intergovernmental organization founded in 1960 to coordinate oil policies among member countries, stabilize crude markets, and ensure revenue for producers through supply and price management. Based in Vienna, it’s comprised of the world’s largest oil-exporting nations.

-

OPEC: The acronym in English for the Organization of the Petroleum Exporting Countries.

-

OPEP: The acronym in Spanish for Organización de los Países Exportadores de Petróleo.

It’s like saying “UN” in English and “ONU” in Spanish. It’s the United Nations Organization in both cases.

Key data about the organization (in both languages):

-

Foundation: 1960 in Baghdad, by five founding countries: Saudi Arabia, Iraq, Iran, Kuwait, and Venezuela.

-

Headquarters: Vienna, Austria.

-

Main objective: To coordinate and unify the petroleum policies of its member countries, and to ensure the stability of oil prices in international markets to guarantee steady revenues for producers and efficient supply for consumers.

-

Current members (13): Saudi Arabia, Iraq, Iran, Kuwait, Venezuela, United Arab Emirates, Algeria, Angola, Congo, Equatorial Guinea, Gabon, Libya, Nigeria.

Read Smart, Be Smarter.

Infonegocios Miami—Economic, Cultural, and Business Intelligence with a Global Lens

Follow us for more analysis: @InfonegociosMiami

Read Smart, Be Smarter!

https://infonegocios.miami/suscribite-al-newsletter

Contact: [email protected]

Infonegocios NETWORK: 4.5 million Anglo-Latinos united by a passion for business.

Join us and stay informed

© 2025 Infonegocios Miami.

Tu opinión enriquece este artículo: