The Backdrop of Opacity: Unveiling Hidden Truths

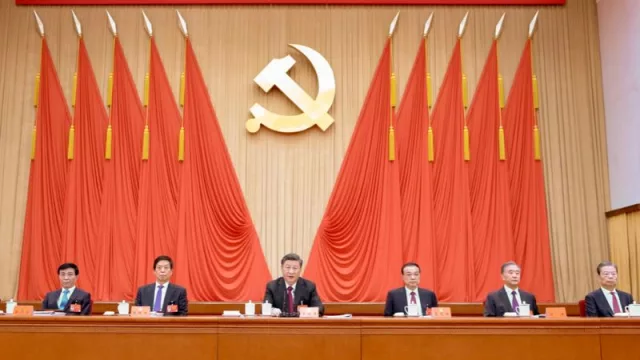

China's economic opacity, perpetuated by Xi Jinping and his government, has led to the disappearance of crucial data. This action, rather than being a mere informational act, becomes a signal that transcends the borders of the Asian nation. The lack of transparency in the economy, under the pretext of regaining power and mitigating social instability, is actually revealing the hand that China is playing on the global stage.

China: From World Leader to Diminished Protagonist

China's once-global economic engine, predicted to surpass the U.S. in 2023 and 2024 by a significant margin, is undergoing a shift in dynamics. While it remains an influential force, its role is no longer the same. The country will continue to progress, but at a more measured pace. As analysts and companies attempt to decipher China's economy, the lack of transparency greatly hampers internal and external understanding of what is truly transpiring within the nation.

Clear Signs of Opacity: A Fanatical Error Revealing Extreme Ideology and Absolute Statism

The sudden decision of the Chinese government to stop publishing the youth unemployment rate is just one piece of the economic opacity puzzle. Although this made headlines, for those closely observing China, it's not surprising. Essential data across various sectors has gradually vanished for years. These comprehensive reports, spanning from exports to cement production, are more critical for understanding the country's structural distress than youth unemployment.

Ideology Over Economic Growth

Xi's China has shifted its focus from prioritizing economic growth to prioritizing party ideology. Despite economic reforms working, Xi has abruptly halted these efforts. The conflict between demand-driven economics and the party's top-down management has created a dilemma. The transformation into a private and domestic economy, driven by demand, conflicts with Xi's vision for the country. This has led to reform stagnation and a shift in direction.

China bears the weight of leading a purported left-wing policy, but that endeavor strains because it must also be competitive, efficient, and thus capitalist, or right-wing. This ongoing tension generates a force—amidst very overt pressures (meaning what's unseen must be far greater)—of a policy that represses dissent or any opposing opinion, press reports, or scientific findings that depict reality and errors, clearly manifesting totalitarianism, lack of freedom, and distortion not only of figures but also guarantees.

This clearly hampers any growth, regardless of whether its population reacts en masse to its ideology. The bigger problem is that its population is beginning to show doubts and reconsiderations toward this continuation of a totalitarian ideology in this day and age.

Impact on Multinationals and Investors

China's economy, though showing signs of structural slowdown for some time, now faces deeper challenges. Foreign investors, along with multinationals like Nike and Starbucks, are affected by this new economic direction. The absence of direct support for households in tough times indicates a shift in priorities. China's economy is no longer the predictable growth bastion it once was, and investors are faced with an uncertain landscape.

The Power of Ideology

The party's ideology has become more apparent in China's economic policy. Xi has shown reluctance to follow the economic stimulus strategy of giving checks to households, favoring political preferences over economic stimulus. The focus on maintaining state control over the economy surpasses any immediate economic consideration. This decision aligns with Xi's philosophy of keeping power in the hands of the state, rather than empowering citizens and private enterprises.

The Path to the Future

Signs of a shift from a growth-oriented economy to a state-controlled regime are clear. The repression of private companies, economic data opacity, and draconian measures are evidence of a new era in China. Reluctance to relinquish economic power and prioritizing party ideology over economic growth affect both China and the global community.

The Darkness that Reveals Truth

By concealing the extent of its economic issues under the veil of opacity, China believes it is regaining power and maintaining stability. However, it's revealing its hand in a way that impacts the global community. Financial instability, opaque practices, and prioritizing party ideology form a combination that challenges understanding and economic stability in the present world.

Trying to Hide the Sun with One's Hand: the Hand of Ideology

In an increasingly interconnected world, China's economy and its opacity impact not only on a national level but also resonate globally. The transformation from an open and growing economy to an opaque and controlled system affects business decisions, investments, and financial stability everywhere. Opacity may appear an attempt to hold onto power, but it's revealing more than China might have anticipated.

With a focus on party ideology over economic growth, China faces significant challenges on the global stage. State control and lack of transparency may provide temporary stability but also generate uncertainty among investors and international actors. China's economy, once a shining light, now stands at a crossroads between its growth past and its controlled opacity future. Ultimately, only time will reveal the true implications of this shift in economic and political direction.

Tu opinión enriquece este artículo: