Check out this insightful article on the vital importance for world economies of creating international companies and receiving a diversity of multinationals in their domestic markets:

Latin America Offers Attractive Investment Opportunities

For those interested in trading Latin American companies, platforms like Hantec Markets provide integrated solutions. Staying informed through reliable sources like CNBC Latin America and Reuters is crucial, as is considering political stability and regulatory frameworks. The region's diverse economy, with key sectors such as mining, telecommunications, and energy, adds an additional layer of complexity to investment strategies.

Latin America's Strongest Companies

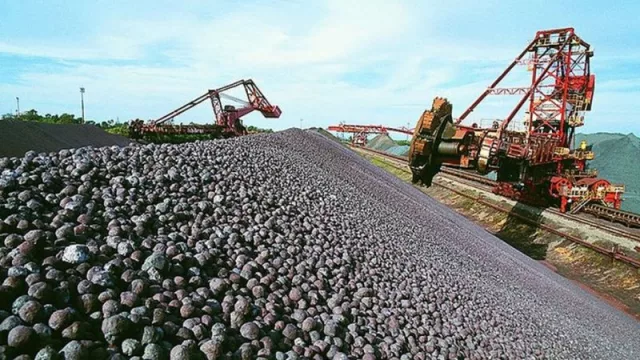

Vale S.A. (Brazil)

-

The flagship of Latin American companies, Vale S.A., a Brazilian multinational mining company, leads the list. With a history spanning over seven decades, Vale demonstrates a consistent commitment to innovation and sustainable practices. Its goal of using 100% renewable energy globally by 2030 sets it apart. Despite stock fluctuations, the robust track record suggests potential for recovery, making this possibly an opportune moment for investment.

Walmart Mexico (Mexico)

-

The Mexican division of the retail giant Walmart, Walmart Mexico, has emerged as a dominant force in the Latin American sector. Since its acquisition of the Cifra chain in 1991, it has experienced exceptional growth, diversifying its presence with the recent acquisition of Trafalgar Digital SA de C.V. The Latin American food industry is projected to grow by 5% in 2023, indicating significant potential returns for companies like Walmart Mexico.

América Móvil S.A. (Mexico)

-

América Móvil, a powerhouse in Latin American telecommunications, has risen as a leader since its founding in 2000. Originating as a derivative of Telmex, it has strategically acquired telecommunications operators, consolidating its position in the market. Despite fierce competition, its global presence provides some security against regional setbacks.

Mercado Libre (Argentina)

-

Known as the "eBay of Latin America," Mercado Libre has revolutionized e-commerce and digital payments since its inception in 1999. Diversifying into Mercado Pago and Mercado Envíos has strengthened its position as a constantly expanding e-commerce ecosystem. Its inclusion in the Financial Times' "Fastest Growing Companies in America 2023" list highlights its profit potential.

Petrobras S.A. (Brazil)

-

Petrobras, a key player in the Latin American energy sector since 1953, has evolved into a global oil and gas corporation. Despite challenges such as corruption scandals, recent stability in stock prices indicates resilience. Future environmental policy will be decisive, but its role in Brazil and globally stands out.

Ambev S.A. (Brazil)

-

Ambev, the Brazilian beverage company, formed in 1999 through a merger, has a rich history dating back to the 19th century. Although the pandemic impacted stocks, the recent 7.88% increase suggests a potential recovery. With iconic brands like Brahma and Skol, Ambev remains a standout in the Latin American brewing industry.

Itaú Unibanco Holding S.A. (Brazil)

-

As one of the largest financial institutions in Latin America, Itaú Unibanco has a history dating back over a century. Merged in 2008, it has faced challenges but maintains a post-pandemic upward trend. Its focus on technology, financial inclusion, and sustainability positions it as a key player in the regional financial landscape.

Grupo México (Mexico)

-

With origins in copper mining in 1942, Grupo México has become a leading mining corporation in the Americas. Despite labor disputes, its aggressive acquisition strategy has been key to expansion into other sectors. Resolving disputes is vital to unleash its true growth potential.

WEG S.A. (Brazil)

-

WEG S.A., a global leader in electrical equipment since 1961, has experienced annual growth of 38.12%. Its commitment to innovation and sustainability, evident in projects like electric vehicles, positions it as a standout company in its industry.

Fomento Económico Mexicano (Mexico)

-

With over a century of history, FEMSA stands out as a multinational conglomerate. The acquisition of Coca-Cola FEMSA marked a milestone, positioning it as one of the largest bottlers in the world. With a year-on-year increase of 73.52%, it demonstrates that business simplification and strategic sales have been well-received by investors.

Tu opinión enriquece este artículo: